Introduction

Mutual funds play a significant role in the world of investing, thereby helping individuals grow their wealth. Moreover, making informed investment decisions requires a comprehensive understanding of the various types of mutual funds. Therefore, this blog aims to simplify explanations of different types of mutual funds and their schemes and shed light on hybrid mutual funds. Additionally, we will discuss mutual fund pricing to provide a comprehensive overview.

Understanding Mutual Funds

Mutual funds are portfolio diversifiers that combine money from various participants to invest in securities such as stocks, bonds, and other assets.

Benefits of Investing in Mutual Funds

Here are a few key points that define mutual funds and their benefits of investing in mutual funds:

- Diversification: Investors can diversify their portfolios by pooling money with others through mutual funds, thereby reducing the risk associated with individual stock or bond investments. Additionally, this pooling of funds allows for a broader range of investment opportunities, which increases potential returns.

- Professional Management: Furthermore, experienced professionals diligently manage mutual funds, conducting in-depth research and making informed investment decisions on behalf of the investors. Consequently, individuals with limited knowledge of the financial markets can benefit from this expertise.

- Access to Various Asset Classes: Mutual funds grant investors access to a broad spectrum of asset classes such as stocks, bonds, and commodities. Consequently, investors can capitalize on the performance of diverse sectors and diversify their investments across various industries.

- Liquidity: Most mutual funds offer high liquidity, meaning investors can easily buy or sell their shares at the prevailing net asset value (NAV) on any business day. This flexibility provides investors with the ability to access their funds when needed.

- Affordability: Individuals can invest relatively small amounts of money, which makes mutual funds accessible to a wide range of investors. Moreover, investing in mutual funds generally incurs lower costs when compared to direct investments in individual securities.

- Transparency: Mutual funds provide regular updates and reports, including the fund’s holdings, performance, and expenses. This transparency enables investors to make more informed decisions and track the status of their investments.

- Systematic Investment Options: Mutual funds offer systematic investment plans (SIPs), enabling investors to invest a fixed amount regularly. This approach aids individuals in accumulating wealth progressively.

By leveraging these benefits, investors can harness the potential of mutual funds to achieve their financial goals and build long-term wealth.

Exploring Types of Mutual Funds

Equity Mutual Funds: Capitalizing on Stock Market Opportunities

Equity mutual funds primarily invest in stocks. These types of mutual funds offer investors opportunities for growth in different companies.

Debt Mutual Funds: Stability and Regular Income

Debt mutual funds are the types of mutual funds that focus on fixed-income securities such as bonds, providing stability and regular income to investors.

Hybrid Mutual Funds

Hybrid mutual funds offer a balanced investment approach, combining elements of equity and debt. They provide diversification, moderate returns, and carry risks associated with both equity and debt investments.

Index Mutual Funds: Tracking Market Performance

Index mutual funds replicate specific market indices. These types of mutual funds aim to match their performance by investing in the same stocks and proportions.

Money Market Mutual Funds: Short-term Security

The types of mutual funds that invest in highly liquid, low-risk instruments, such as Treasury bills, providing short-term security to investors are known as Money market mutual funds.

Exploring Different Types of Mutual Fund Schemes

Open-Ended Mutual Funds

Investors can buy or sell units of open-ended mutual funds anytime, without limit on the number of units issued. Additionally, they can perform these transactions without restrictions or constraints.

Closed-Ended Mutual Funds

Closed-ended mutual funds issue a fixed number of units through an IPO and trade them on stock exchanges.

Interval Mutual Funds

Interval mutual funds allow periodic purchase or redemption of units, combining features of both open-ended and closed-ended funds.

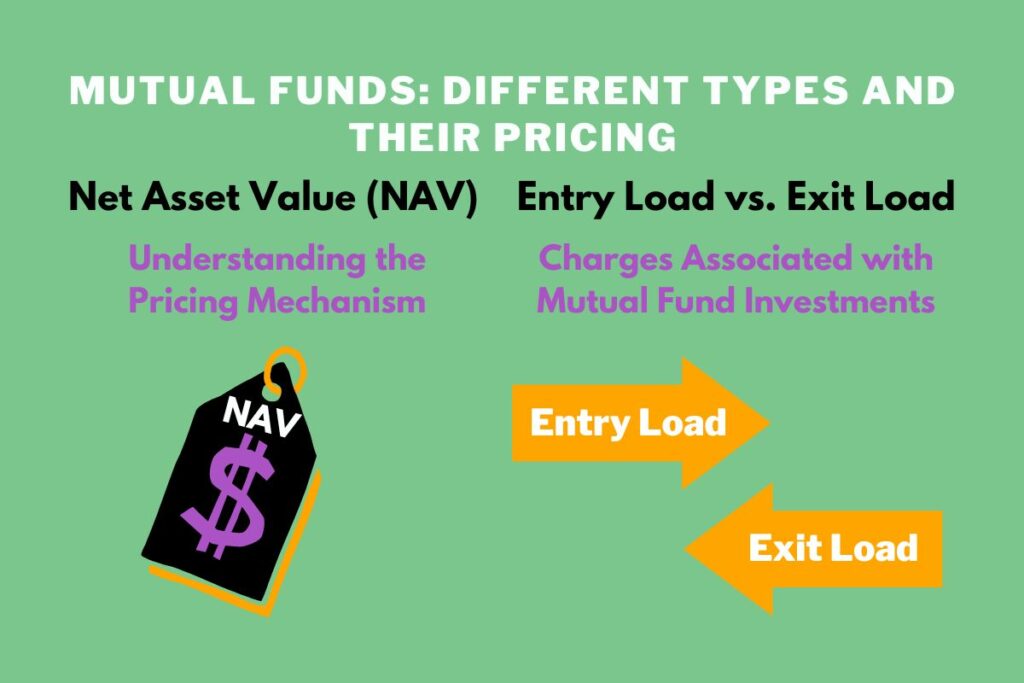

Mutual Funds: Different Types and Their Pricing

Net Asset Value (NAV): Understanding the Pricing Mechanism

NAV represents the per-unit value of a mutual fund scheme, calculated by dividing the total value of assets by the number of units.

Entry Load vs. Exit Load: Charges Associated with Mutual Fund Investments

Entry load refers to charges when purchasing mutual fund units, while exit load pertains to charges when redeeming or selling them.

Conclusion

Understanding different types of mutual funds empowers investors to make informed decisions and build well-diversified investment portfolios. Exploring types of funds allows individuals to choose options aligning with their financial goals and risk tolerance. Mutual funds provide a flexible and accessible avenue for long-term wealth creation, whether aiming for growth, stability, or a combination of both.

Also Read: Digital Marketing Jobs For Freshers: Unlocking Opportunities In 2023.

One thought on “Types Of Mutual Funds & How They Get Priced: Explained!”